17 September 2021

Cameroon is grappling with the COVID-19 pandemic as are most countries around the world. Since the beginning of the pandemic, 82,454 reported Cameroonians (around 3% of the population – compared with around 10% in the US) have been contaminated by the virus and 1,338 are reported to have lost their lives. Compared to peers in the region, Cameroon has reported more absolute cases, but compared to the size of its population, Cameroon’s cumulative confirmed Covid-19 cases have been one quarter of Gabon’s and just 5 percent of Equatorial Guinea’s. However, with different levels of Covid-19 testing across different countries, these numbers have to be interpreted cautiously and Covid-19 cases are likely to be much higher than the reported cases.

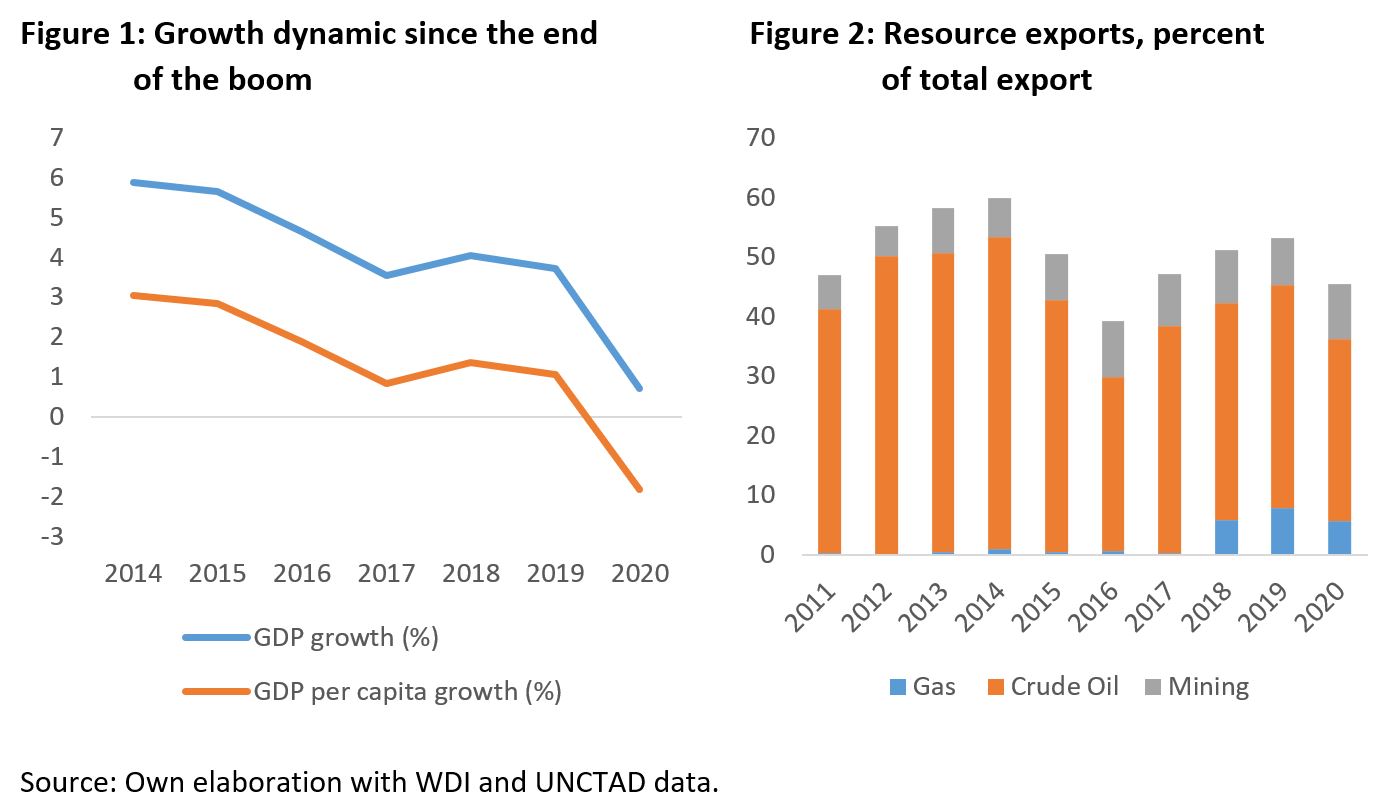

Although it seems as if Cameroon might have been relatively spared so far, compared to many other countries around the world, the economic impact of Covid-19 is huge. The Cameroonian economy, which still hasn’t recovered from the end of the oil boom in 2014, has been hit hard by the COVID-19 pandemic. GDP growth collapsed from 3.72 percent in 2019 to 0.73 percent in 2020 (Figure 1). Moreover, GDP per capita growth was negative in 2020 and declined from 1.07 percent to – 1.81 percent in 2019, suggesting a reversal of poverty reduction gains.

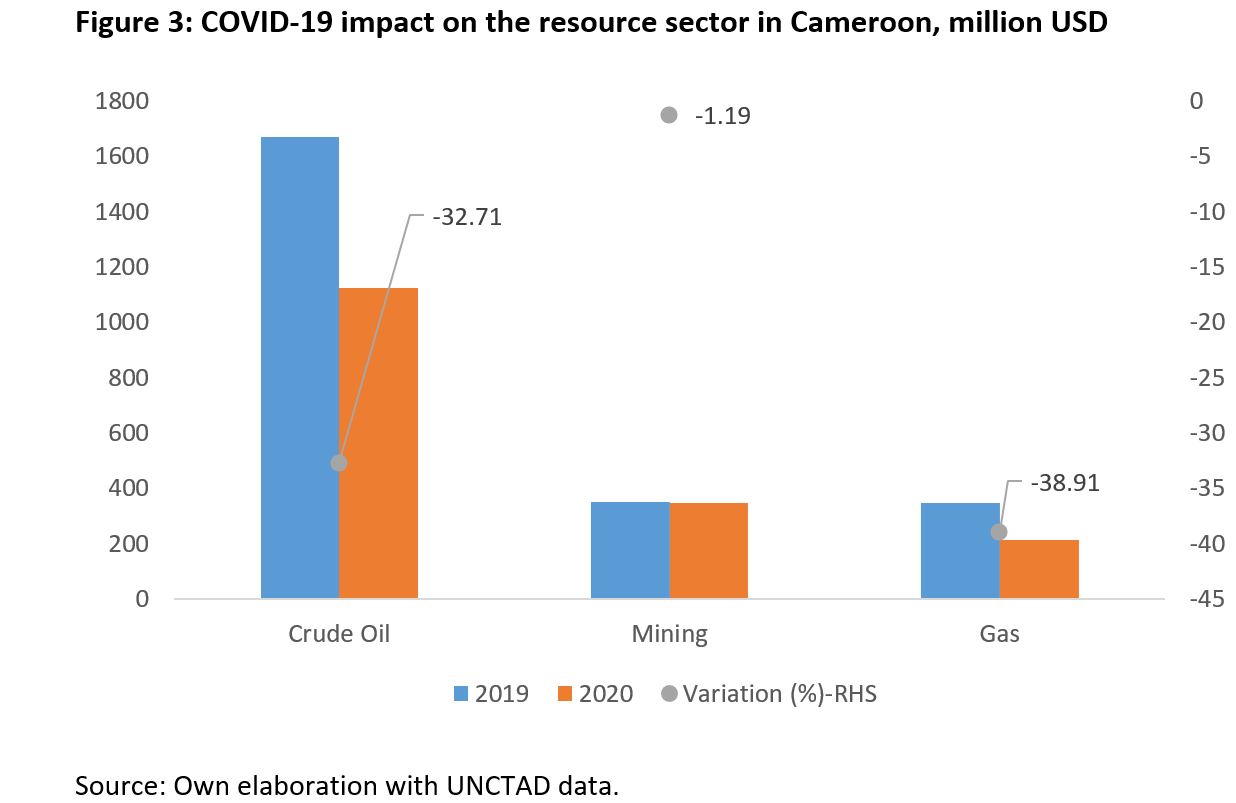

The resource sector which has been one of the most important drivers of Cameroon’s economic growth has been particularly hit by the pandemic. The country relies significantly on commodities, primarily oil and gas, which have been significantly impacted by the collapse in prices triggered by the slowdown of the global economy. Hydrocarbon exports represented more than half of GDP, on average, during the boom (Figure 2). Mining products, such as diamond and gold exports are relatively limited and primarily exploited by artisanal producers. Nonetheless Cameroon produces Aluminum, representing around 6 percent of GDP, on average, during the commodity boom.

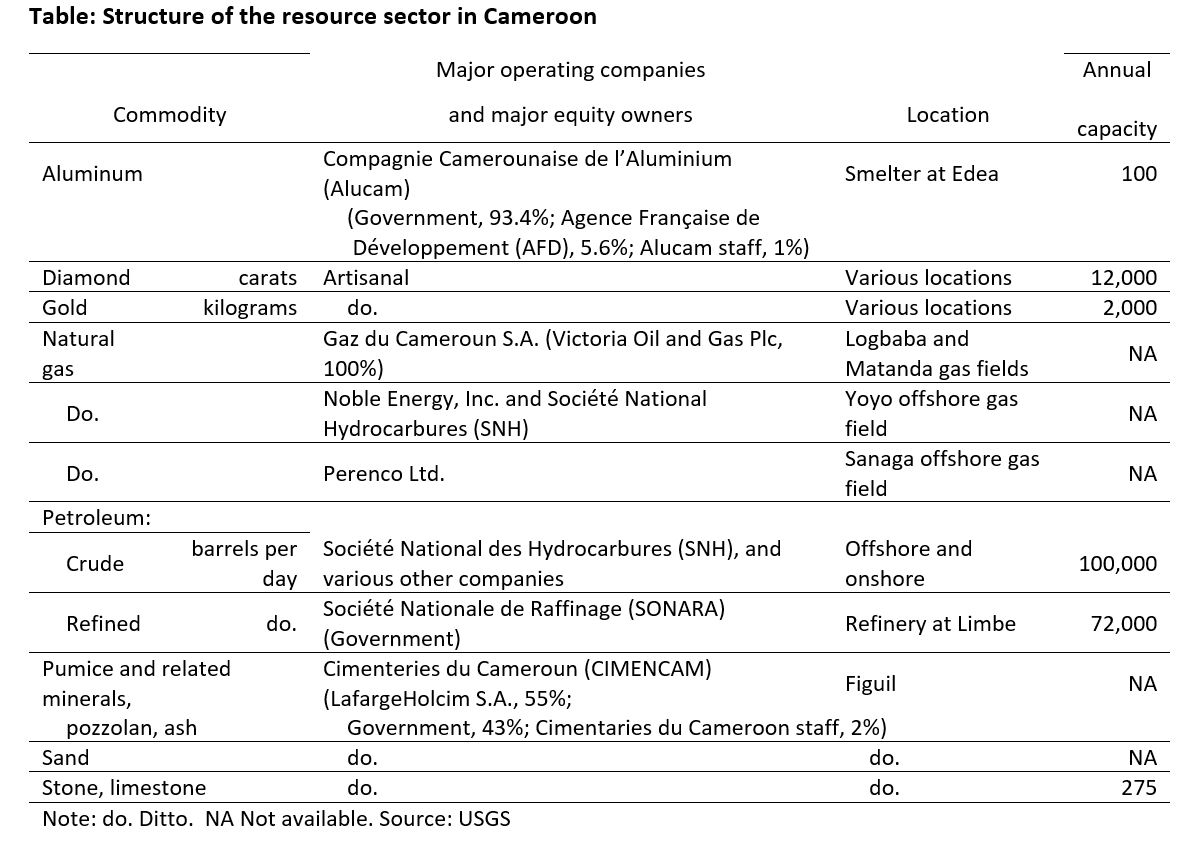

COVID-19 has reversed the long recovery process of Cameroon’s resource sector. After four years of gradual increases in resource exports between 2015 and 2019 the natural resource sector collapsed significantly in 2020. Gas and oil were the main drivers of the collapse in resource exports, having decreased by 39 percent and 33 percent respectively. The mining sector has been more resilient – exports decreased by just 1 percent between 2019 and 2020 (Figure 3).

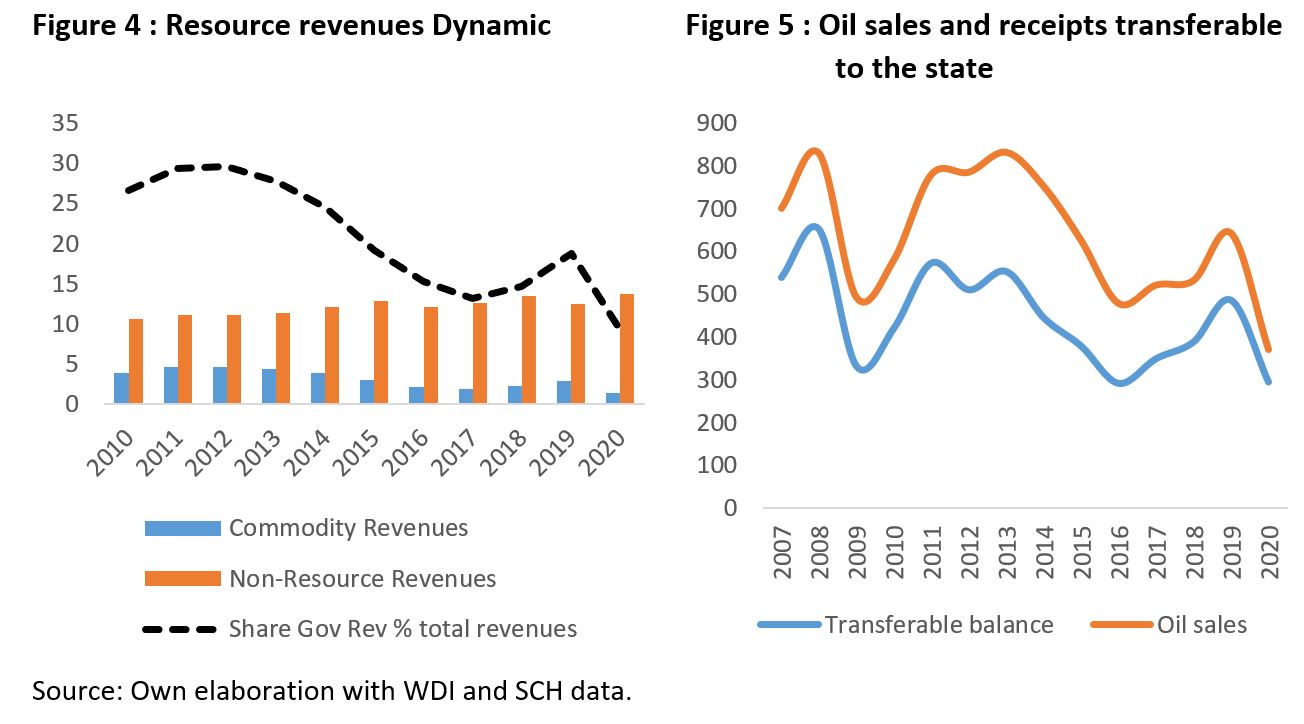

The contribution of resource exports to government revenues has reached its lowest level in 2020 and the Covid-19 impact is bigger than the 2014 oil crisis. Government resource revenues, which have increased in 2018 and 2019 after 3 successive years of decline, have been particularly hit by the COVID-19 pandemic and the collapse in oil prices. The revenues stemming from the resource sector ranged from 2.9 percent of GDP in 2019 to 1.38 percent of GDP in 2020, representing a 52 percent decline. Accordingly, the contribution of resource revenues to government revenues has reached its lowest level during the last decade in 2020, 9 percent of total government revenues, compared to around 28 percent, on average, during the boom and 16 percent between 2015 and 2019. Moreover, as Figure 5 shows, the transferable balance from the National Hydrocarbons corporation sales are at their lowest level since 2016 and the sales made by this National Oil Company in 2020 are below the lowest level reached after the collapse in oil prices in 2014, suggesting that the COVID-19 impact is bigger than the 2014 oil crisis.

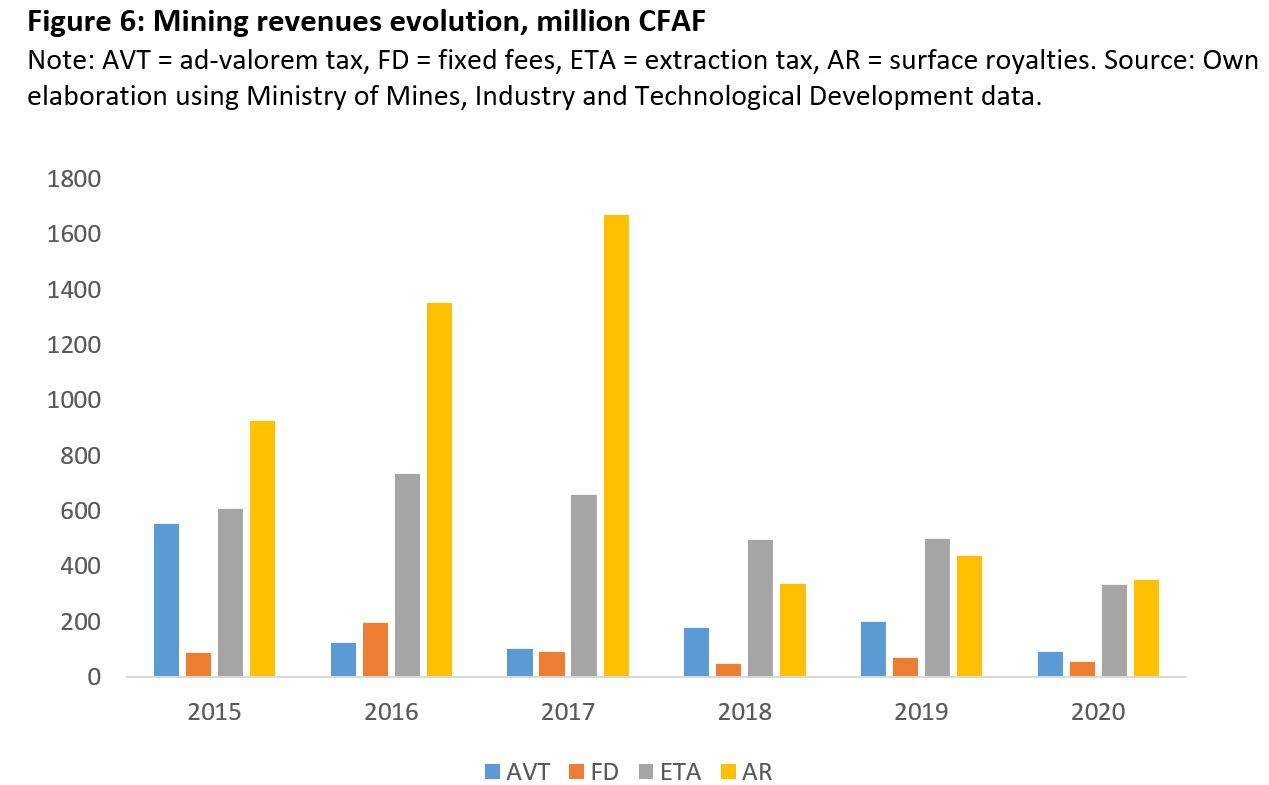

In the mining sector, as Figure 6 shows, government revenues decreased as well. Some artisanal mines are shut. For instance, the royalties collected by the government collapsed by almost 50%. The impact of the pandemic on extraction tax (ETA) collection is also significant: the drop in ETA is primarily caused by the slowdown of mining activities following the shutdown of certain mining companies. In the artisanal gold mining sector, MENCHENG Mining, SHAOLING Mining, and ZHENGOU Mining have reduced their production, while GOOD LUCK Mining and METALICON have closed their mines completely.

In addition to the measures undertaken to contain the spread of the virus, the government put in place support packages to reduce the economic impact of the pandemic. Given the importance of the resource sector for Cameroon’s economy, the government provided support measures, such as free registration of agreements for the repurchase and securitization of domestic public debt to support companies’ cashflow by clearing outstanding debts. The government also granted a postponement of royalties and social charges, an exemption from import duties, an immediate deduction or tax credit for health-related expenses, an acceleration of the repayment of VAT-credits to reduce the pressure on the cash flow of companies and protect them against the depreciation of the exchange rate that would erode the value of the refunds[1].

The COVID-19 pandemic reminds resource-rich countries, such as Cameroon, of the need to diversify their sources of economic growth and most importantly increase domestic revenue mobilization. On the resource sector side, the government is adopting numerous policy changes to the oil, mining, and gas fiscal regimes to incentivize investment. By the end of May 2020, 245 projects in industry, cement and metallurgy have benefited from tax incentives, with 92,664 new jobs projected[2].

To increase revenue mobilization, new measures are being undertaken by the government. The main innovation of the 2020 finance law for the 2021 fiscal year is the digitalization of administrative procedures. These innovative measures introduce electronic payment and mobile money for tax collection to reduce cash transactions between tax administration and taxpayers. While economic recovery in Cameroon is still a long way ahead, policies to diversify growth and increase domestic revenue mobilization are already underway.

[1] General Tax code 2021.

[2] Budgetary orientation debate: medium-term economic and budget programming document 2021-2023.